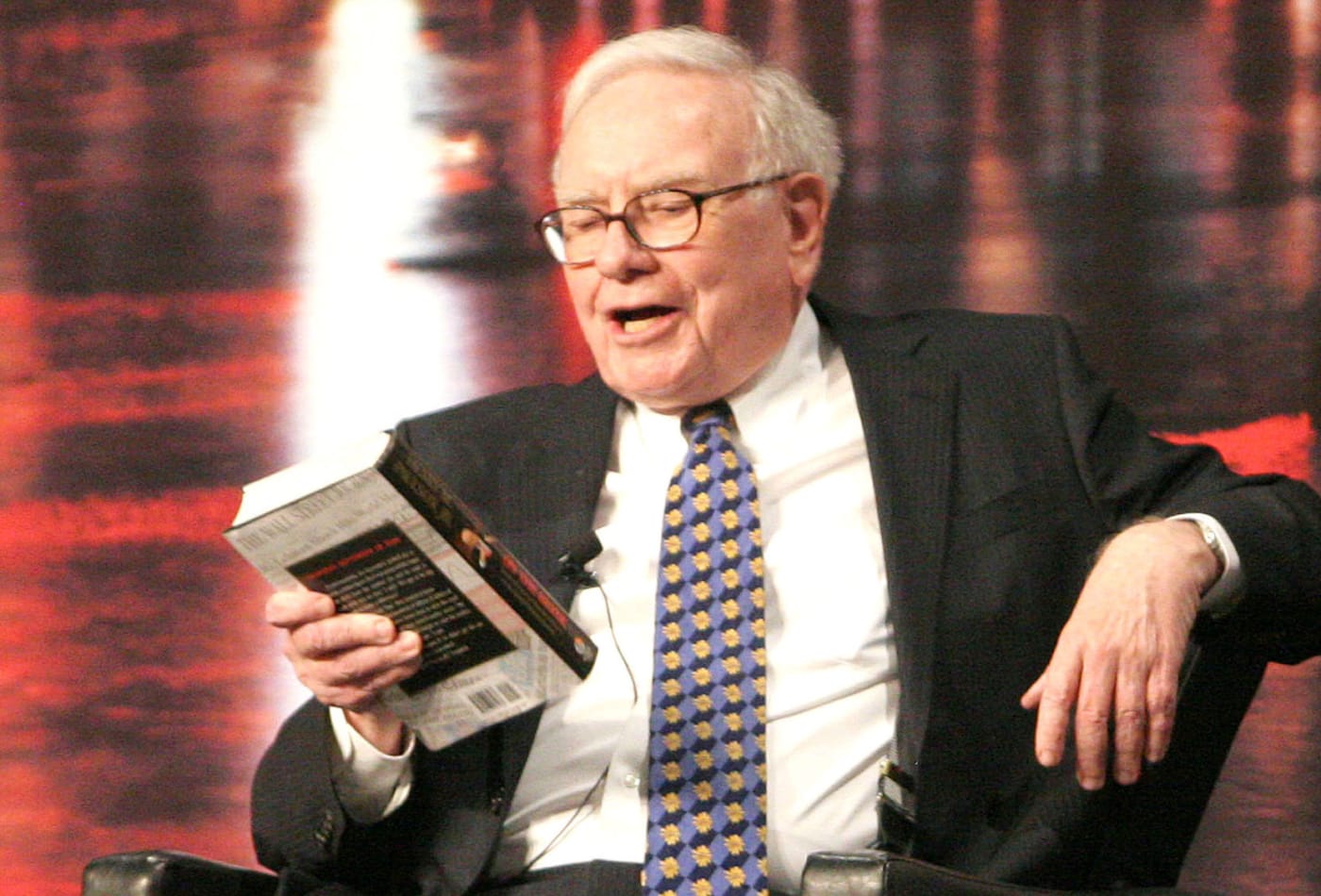

“If you don’t find a way to make money while you sleep, then you will have to work until you die.” Doesn’t that sound familiar? Yes, this quote has been said by Warren Buffett. We have covered many interesting business people and entrepreneurs on our website. But there are very few who are as famous and legendary as Warren Buffett.

Born during the Great Depression, Warren Buffett went on to become world-famous for his wealth and investment savvy. He’s a stalwart of value investing and the traditional cornerstone of investment. As a result, he was named the richest person on the earth in 2008. Currently, he is the 6th richest person on the planet.

Introduction

Warren Buffett is called an American business tycoon, philanthropist, and investor. He is the chairman and CEO of Berkshire Hathaway, which owns more than 60 companies, including insurer Geico, battery maker Duracell and restaurant chain Dairy Queen. He is known as one of the best investors of all time. Currently, his net worth is $102.8B, as per Forbes.

Origin/Background

In 1869, Buffet’s family was brought up in Omaha, Nebraska, U.S. His great grandfather Sidney Buffet left the farmer’s life in Long Island New York, to go west. He (Warren’s Great Grandfather) started working as a stagecoach driver. Later, he opened a grocery store. By valuing every penny, Sidney was able to earn a decent profit and soon expanded the business to meet Omaha citizens’ demands. In 1915, His son Ernest (Warren’s grandfather) took over the store and moved its location from downtown to the suburbs.

Over time, Ernest made huge profits and reinvested in the business. However, Ernest’s son Harvard Buffet (Warren’s father) was not interested in the grocery business. After graduating from the University of Nebraska, Harvard started his career at an insurance company. It was time when Warren Edward Buffet was born.

Early Life and Education

Warren Edwards Buffett was born on August 30, 1930, in Omaha, Nebraska. The 2nd child and the only son of Leila and Congressman Howard Buffett. As a boy, Warren Buffett was always good with numbers and could easily do complex math calculations in his mind. At the age of 8, he started reading his father’s books on the stock markets; at age 11, Warren Buffett marked the board at the broker house where his father worked. His early years were enlivened by entrepreneurial ventures.

In one of his first business ventures, he sold Coca-Cola, a weekly magazine door to door, golf balls, and stamps. He also worked at grandfather stores. On his first income tax return in 1944.

In 1945, as a high school student, he and his friend spent $25 to buy a used pinball machine, which they placed in a local barbershop. Within the months, they purchased several Pinball machines and installed them all across barbershops. Later, he sold the business for $1,200. He was so successful that he told his father he didn’t want to go to college and jump directly into business. He was overruled.

His education began at Rose Hill Elementary School and later he attended Alice Deal Junior high school. After graduating from high school, he went to the business school of the University of Nebraska, and while there, he read a new book on investing by a Columbia professor named Benjamin Graham.

It was, of course, The legendary and great investor. He was so involved with Gram’s idea. He applied to Columbia Business School so that he could learn directly from Graham. He recalls that there was instantaneous mental chemistry between Warren Buffett and Graham and that the rest of the class was primarily a spectator.

Career

Not long after Warren Buffett received a master’s degree from Columbia University in economics. Graham Newman gave an invitation to his former student to join his company named the Graham-Newman Corporation. During his two-year tenure there, Warren Buffett became fully immersed in his mentor’s investment approach.

In 1956, Warren’s mentor Graham disbanded. Later, Graham retired from the company. While Buffet returned to their hometown Omaha. Armed with high knowledge in investment, he started a limited investment partnership.

Later, his partnership grew and began with seven limited partners who together contributed $105,000. The limited partners got 6% yearly on their investment and 75% of the profits above this bogey; the rest 25% went to Warren Buffett, who as a general partner had essentially free rein to invest the partnership’s funds. Over time, his percentage grew from 25 to 29.5%.

As Buffett’s reputation grew, more people started demanding he manage their money. In 1962, he began accruing shares in an ailing textile company named Berkshire Hathaway. Same year Buffett moved the partnership office from his home to Kiewit Plaza, where his office stays today.

Trained by a scandal involving one of its clients, American Express saw its shares drop from $65 to $35 almost overnight. At the time, he had received this lesson from guru Graham: if the stocks of strong companies are selling below their calculated value, act wisely. He made a bold move to invest 40% of the partnership’s total assets into American express. Within two years, his shares tripled. They made $20 million in profit.

By 1965, the value of their assets was $26 million. After four years, explaining that he found the market’s highly speculative worthwhile values increasingly scarce. Then, he decided to close the investment partnership.

When the partnership separated, investors got their proportional interest. Some of the members recommended Buffett, and others sought out money to manage Bill Ruane. Bill agreed to manage their money, and thus the Sequoia Fund was born. Others, including Warren Buffett, invested their revenue in Hathaway. By that time Buffett shared had grown to $25 million, which gave him permission to control Hathaway. In 1970, he became chairman and CEO of the Company Berkshire Hathaway Inc.

From 1970 to now, he has invested in many famous and leading companies like Apple, Coca-Cola, Amazon, and more.

Some interesting, and most inspiring facts about Warren Buffett

He is the son of a U.S congressman, first bought the stock at the age of 11, and pays the tax at the age of 13.

Warren Buffett has made promises to donate over 99% of his wealth to charity. So far, he has given over $41 billion, mostly to the gate’s foundation and his kid’s foundation.

In 2010, he and his beloved friend introduced a program called Giving Pledge, asking a billionaire to commit to donating at least half of their wealth to charitable causes.

He still has the live-in same house, which he bought in 1956 in Omaha, Nebraska.

Buffett was rejected from Harvard Business School.

One of the most famous quotes from Warren Buffett :

“If you cannot control your emotions, you cannot control your money.”